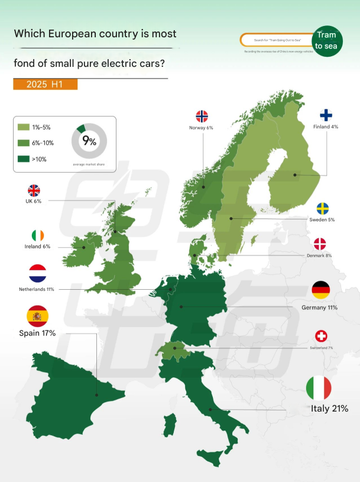

Italy's favorite small pure electric car

In the first half of 2025, Italy's share of the small pure electric sedan market reached 21%, far exceeding the European average (9%) and leading major markets such as Spain (17%) and Germany (11%), making it the country with the highest acceptance of this segment in Europe.

This is due to two main reasons: first, Italy's inherent preference for compact, maneuverable, and easy-to-drive urban vehicles; second, high fuel prices and urban traffic restrictions have made small electric cars more practical and cost-effective.

Additionally, the market appeal of domestic models such as the Fiat 500e has further boosted the overall market share.

In contrast, established electric vehicle powerhouses like the UK, Norway, and Sweden have relatively low market shares in this segment, demonstrating that the acceptance of small pure electric sedans remains significantly different across countries.

Italy's favorite small pure electric SUV

By the first half of 2025, small pure electric SUVs accounted for 20% of the Italian new car market, far exceeding the European average (8%) and significantly ahead of markets like the Netherlands (11%), Spain (10%), and Ireland (9%). This marks Italy's "double crown" in two core electric vehicle market segments.

Why are small pure electric SUVs so popular in Italy?

The key lies in their combination of practicality and attractive appearance: they are suitable not only for urban commuting but also for family travel. Their compact size and relatively affordable price perfectly meet Italian consumers' expectations for flexibility and value.

In contrast, Nordic countries generally have a relatively low share of this market segment, with Denmark accounting for only 2% and Norway for only 4%, reflecting differences in consumer structure and preferences.

This serves as a reminder to automakers that when competing in the European market, they shouldn't simply focus on the overall market; the real opportunities often lie in local breakthroughs in specific countries and segments.

Ireland's Favorite Compact Pure Electric Sedans

By the first half of 2025, compact electric sedans accounted for 8% of Ireland's new car market, double the European average and surpassing traditional electric vehicle powerhouses like Germany (6%), the Netherlands (5%), and Finland (5%), making it the European champion in this segment.

In a market dominated by electric vehicles that are either small or large, Ireland's preference for compact electric sedans stands out.

They offer more space than small cars and are not as expensive as mid- to large-sized sedans, perfectly meeting Irish consumers' demand for practical yet affordable family transportation.

In contrast, in Southern and Northern European countries, the penetration rate of this segment is generally lower, mostly around 3%, indicating that compact electric sedans remain in a transitional phase between niche and mainstream in Europe.

Precisely because of this, whoever can pioneer high-volume and differentiated products in this segment may capture an underserved user base.

Ireland's Favorite Compact Electric SUV (Under €40,000)

In the first half of 2025, compact pure electric SUVs in this price range accounted for 23% of the Irish new car market, significantly exceeding the European average (14%) and surpassing the next closest countries, Denmark (21%) and the Netherlands (20%), making it the top European market share in this segment.

The core appeal of this type of vehicle lies in its "adequate size without compromising price."

For markets like Ireland that prioritize family practicality and are sensitive to car purchase budgets, small SUVs that offer both spaciousness and affordability hit the sweet spot. Coupled with supportive local tax and subsidy policies, this type of electric vehicle has become the preferred choice for many consumers.

Interestingly, Italy, traditionally known for its compact models, ranked last this time, with a market share of only 5%, demonstrating a clear divergence in price sensitivity and vehicle preferences across countries.

Spain's Favorite Compact Pure Electric SUV (over €40,000)

In the first half of 2025, this segment accounted for 9% of new cars sold in Spain, slightly higher than Finland and the Netherlands (both 8%), and surpassing the UK, Switzerland, and Nordic countries, where penetration rates for traditional mid- to high-end models are high, making it the largest market in Europe for compact electric SUVs in this price range.

Compared to the lower-priced market, which emphasizes value for money, compact electric SUVs priced above 40,000 euros emphasize brand power, features, and driving experience.

The enthusiasm of Spanish consumers in this price range may also be related to the increasing acceptance of new energy upgrades among local middle-class families in recent years.

In contrast, Germany, with only a 3% market share, is a low point in this segment, demonstrating that premium electric compact SUVs still face challenges in gaining acceptance among German families.

Overall, the average penetration rate for this segment is only 6%, indicating that it is still in its early stages. However, some countries have shown growth momentum, making this a "mid-segment focus" worth continuing to monitor for automakers targeting the mid- to high-end market.

Sweden's Favorite Midsize Electric Sedans

In the first half of 2025, mid-size pure electric sedans accounted for 12% of Sweden's new car market, slightly higher than Spain and Ireland (both 11%) and above the average (9%), making it the country with the highest share of this segment in Europe.As vehicles that combine space, comfort, and range, mid-size pure electric sedans are establishing a stable mainstream user base in Europe.In Nordic markets like Sweden, these vehicles are not only suitable for long-distance family travel but also highly resonate with the local emphasis on vehicle safety and range.Overall, this segment has a relatively balanced regional distribution. Germany, Italy, and the UK all account for 9%, roughly close to the average. Even Norway, with its higher penetration rate of new energy vehicles, only has an 8% share, indicating that while the mid-size pure electric sedan market has taken shape, it is far from reaching its peak.

Norway's Favorite Mid-Size Pure Electric SUV (Under €46,000)

In the first half of 2025, mid-size pure electric SUVs priced under €46,000 accounted for 33% of the Norwegian new car market. This not only far exceeded the European average (19%), but also significantly surpassed markets like Finland, Denmark (both 24%), and Switzerland (23%), making it the most representative consumer hotspot in this price segment.

Mid-size SUVs are already widely suitable for families in Europe, and keeping prices below €46,000 puts them squarely within the coverage of preferential policies such as policy subsidies and tax breaks. This makes them a prime option for countries with high electric vehicle penetration, especially in Norway.

The data also shows a clear Nordic advantage in this market segment, with the top six positions almost exclusively held by Nordic and neighboring countries, while Southern European countries like Spain (13%) and Italy (11%) lag behind, indicating differences in price sensitivity and vehicle model acceptance.

For automakers, this represents one of the greatest opportunities in the European electric vehicle market, offering both value and scale. Choosing the right size and price point might just win the hearts of the next wave of mainstream buyers.

Denmark and Germany's Favorite Mid-Size Pure Electric SUV (46,000-60,000 Euros)

This time, Denmark and Germany tied for first place.

In the first half of 2025, mid-size pure electric SUVs in this price range each accounted for 8% of the new car market in Denmark and Germany, slightly above the average (6%) and ahead of major markets such as Italy, Switzerland, and the Netherlands (all 7%), becoming the leading market for compact family cars in this mid-to-high-price segment.

Products in this segment are often positioned between "above basic needs but below luxury," emphasizing a comprehensive balance of features, design, and space. They meet the demands of family users for quality and practicality without the prohibitive price tags of high-end models.

Overall, the market share differences among countries in this segment are not significant, indicating that competition in this price range is fierce within the mid-size electric SUV market, with no clear consumer concentration yet.

Sweden's Favorite Mid-Size Pure Electric SUV (over €60,000)

In the first half of 2025, mid-size pure electric SUVs priced over €60,000 accounted for 6% of the Swedish new car market, the highest share in Europe and far exceeding the average market share of 3%. Other countries, such as Switzerland (4%), the UK, and Finland (all 3%), lagged slightly behind.

This segment falls into the mid-to-high-end market, emphasizing luxury, rich features, and premium branding. Swedish consumers' high standards for quality and technology make models in this price range more popular there.

Overall, the penetration rate of mid-size pure electric SUVs in this price range remains low in most European countries, indicating that this segment is still in its infancy and has limited penetration.

For automakers, this means that the high-end mid-size pure electric SUV market, while small, remains crucial for brand image and technology demonstration, making it a crucial battleground for building a high-end image and attracting high-quality customers.

Germany's Favorite Mid-to-Large Pure Electric Sedans

In the first half of 2025, mid-to-large-sized pure electric sedans accounted for 5% of the German new car market, far exceeding the levels in other European countries, making them the market leader in this segment. Switzerland ranked second with 3%, while Finland, Sweden, Denmark, and other countries all had shares between 1% and 2%.

Overall, the average share of mid-to-large-sized pure electric sedans in the European market is only 1%, indicating that this segment is still in its infancy and far from mainstream.

This also reflects that European consumers' demand for mid-to-large-sized luxury pure electric sedans has not yet been widely realized, with more people still preferring small-to-medium-sized or SUV models.

Sweden, Norway, and Finland prefer mid-to-large-sized pure electric SUVs

The answer is Sweden, Norway, and Finland, with all three countries tied for the lead.

In the first half of 2025, mid-to-large pure electric SUVs accounted for 8% of the new car market share in each of these three Nordic countries, exceeding the European average of 6%, demonstrating Nordic consumers' strong preference for large, luxury electric SUVs.

Switzerland followed closely behind with a 7% market share, while Germany, the Netherlands, the UK, and Italy all maintained around 6%, creating a relatively balanced yet slightly concentrated Nordic market.

This market segment emphasizes luxury, space, and driving experience, meeting the needs of families and businesses with high demands for comfort and range.

Overall, while mid-to-large pure electric SUVs are not a major player in the mass market, they have demonstrated steady growth in some European countries. For automakers, this is a crucial market for enhancing brand image and profitability, worthy of continued investment and attention.

Ireland's Favorite Large Pure Electric SUV

The answer is Ireland, but the overall market remains extremely limited.

In the first half of 2025, large electric SUVs accounted for only 0.3% of the Irish new car market, ranking first in Europe. The UK, Italy, and Norway followed closely behind, each with a share of around 0.2%. In most European countries, this segment's share is close to or equal to zero.

This reflects that large electric SUVs remain a niche market in Europe, hindered by high prices, high operating costs, and restrictions on urban driving and parking, making them a difficult choice for the mainstream.

Nevertheless, as battery technology and range improve, large electric SUVs may gain more attention in specific market segments, particularly among users who value space and luxury.

Currently, for most automakers, this remains a niche market focused on brand image and high-end customer service, rather than a primary battlefield for scale competition.

Britain's Favorite Large Electric Sedans

In the first half of 2025, large pure electric sedans accounted for only 0.3% of the new car market in the UK, ranking first in Europe. Germany held 0.2%, while the Netherlands, Switzerland, Denmark, Spain, and Italy each held only 0.1%. In most European countries, this market share is close to or equal to zero.

In other words, large pure electric sedans remain a very niche market in Europe, with an average share of only 0.1%.

This serves as a stark reminder for Chinese automakers: the "big car obsession" that is so popular in China is simply not selling well in Europe.

European users are more concerned with daily commuting, urban convenience, and the full lifecycle cost of a vehicle. Large electric vehicles, with their high prices and high energy consumption, are not very attractive to European users.

Norway's Favorite Pure Electric MPV

In the first half of 2025, pure electric MPVs accounted for 7% of Norway's new car market, ranking first in Europe and significantly above the average (3%). Denmark and Spain followed closely behind (both at 6%), while traditional powerhouses like Germany only accounted for 2%. Countries like Italy, the Netherlands, and Finland remained marginal.

MPVs have never been a mainstream consumer preference in Europe, but in some countries, these vehicles are gaining new attention amid the electrification transition due to their spaciousness and suitability for multiple passengers.

In Norway in particular, a mature electric vehicle market and a strong emphasis on family practicality have created a fertile ground for pure electric MPVs.

Overall, however, pure electric MPVs remain a typical "structural opportunity" market, concentrated in a few countries and populations with specialized needs. For automakers, this isn't a market focused on volume, but it can be a key component in brand differentiation and product category completion.

Netherlands' Favorite Pure Electric Station Wagons

The answer is the Netherlands, but this market is still virtually undeveloped.

In the first half of 2025, pure electric station wagons accounted for 0.5% of the new car market in the Netherlands, ahead of Norway (0.3%) and Sweden (0.2%), making them the country with the highest penetration rate in this niche segment in Europe. However, overall, the European average share is only 0.1%, with most countries still starting from zero.

This stands in stark contrast to the station wagon's heyday during the European gasoline-powered era. While countries like the Netherlands still maintain a station wagon culture, this type of vehicle is conspicuously absent in the transition to pure electric vehicles, with scarce products, low market attention, and even less investment from automakers.

Precisely because of this, whoever can first fill this gap is expected to capture stable demand from a specific demographic, such as families who appreciate the station wagon's styling or discerning consumers who value storage space but prefer not to drive an SUV.

This may not be a hot-selling market, but it is a small opportunity for automakers to improve their product portfolios and enhance brand integrity.

Most Popular Pure Electric Sports Cars (Including Coupes) in Germany, Finland, and the UK

The answer is Germany, Finland, and the UK, all tied for first place.

In the first half of 2025, pure electric sports cars (including coupes) accounted for 3% of the new car market in each of these three countries, slightly higher than the European average (2%) and ahead of second-tier countries like Switzerland, Ireland, and the Netherlands.

This market segment emphasizes design, performance, and individual expression, representing a typical non-essential consumer segment. Germany, as a hub of automotive culture and a hub of brands, boasts a more mature user base for high-performance electric vehicles. The preferences of Finland and the UK also reflect the growing popularity of pure electric coupes among certain niche consumer groups.

Overall, however, pure electric sports cars remain a small but high-profile market, primarily serving to showcase brand technology and enhance brand image.

For automakers, while not necessarily having many of these products is essential, they must be present. Even if sales are low, there is a "ceiling" in user awareness.